Shivalik Compounder Fund

Outperforming the market doesn’t have to be guesswork. FidelFolio Shivalik Compounder Fund is a data-driven, fixed-fee portfolio designed to deliver long-term compounding with lower downside and no hidden costs.

- Start with just ₹2,00,000

- Invest in a minutes

- Built on 25+ years of backtested data

- 3 lakhs+ investment rules created

Return Characteristics

Outperformance That’s Consistent, Resilient & Proven

The Shivalik Compounder strategy has demonstrated consistent and reliable outperformance across a decade.

Compared to Nifty 50’s 15% CAGR, the portfolio averaged 21%, with nearly zero downside risk over any rolling 3-year period.

Its Sortino Ratio of 38.1 reflects best-in-class risk-adjusted returns — and 75% of 3-year periods delivered >15% gains.

Built for long-term compounding, this strategy shines in both bull and bear markets.

| Metric | Shivalik Compounder | Nifty 50 |

|---|---|---|

| Mean (3Yr CAGR) | 21% | 15% |

| Median (3Yr CAGR) | 20% | 13% |

| Downside Risk (MAR < 0%) (3Yr CAGR) | 0.2 | 2 |

| Sortino Ratio | 38.1 | 5.1 |

| Probability of 15%+ Returns (3Yr CAGR) | 75% | 38% |

| Average CY Returns (FY14–24) | 17% | 14% |

Business Quality Snapshot

What Defines the Fidelfolio Portfolio

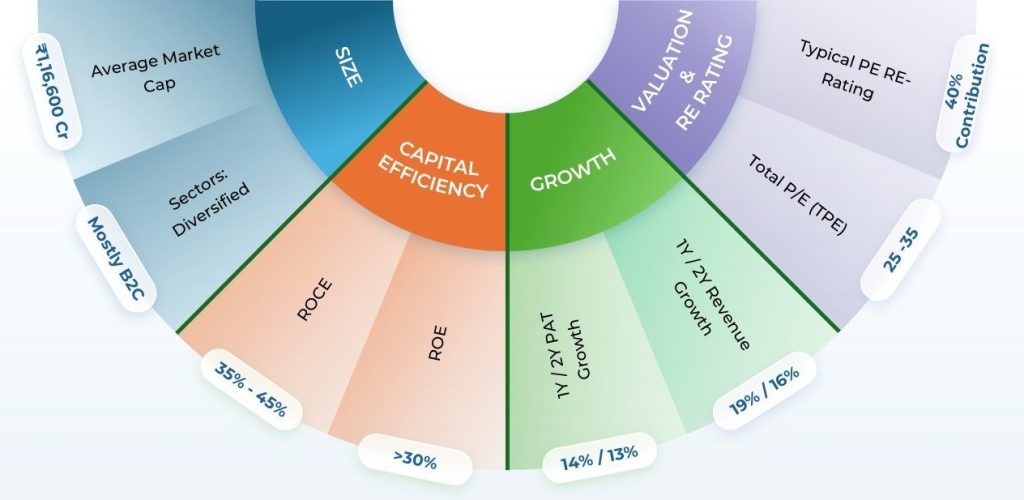

The companies in Fidelfolio’s portfolio consistently deliver high profitability and steady earnings growth.

With mid-30s to 40s ROCE/ROE, PAT and revenue CAGR in the mid-teens, and an average PE in the mid-20s to 30s range — these firms are both efficient and growth-focused.

Roughly 40% of returns have historically come from valuation re-rating, rewarding quality.

The strategy emphasizes strong fundamentals while focusing on established mid to large-cap companies.

Live Performance

Current value of ₹ 100 invested once on Jan 25, 2022, would be

Back-Tested Performance

What Makes FidelFolio Different

Discover how FidelFolio empowers investors with transparent, data-driven investment strategies grounded in 25+ years of historical analysis.

Introducing MAGIC 2.0 – AI for Smarter Investing

Our proprietary AI-ML engine, MAGIC 2.0, tests and combines over 3 lakh investment rules, leveraging decades of financial data to surface the most reliable strategies.

- 20 elite rules powering the Large Cap Dream Funds

- High-return strategies with low downside risk

- Fully transparent fixed-fee structure

Why Trust FidelFolio

At FidelFolio, we prioritize transparency, credibility, and investor-first principles to build confidence and long-term wealth.

We’re not just building portfolios. We’re building investor confidence.

Check out our PortfolioFrequently Asked Questions

At FidelFolio, we follow a quantitative long-term investing approach based on fundamental analysis. Over long-term, company’s business fundamentals determine investment outcomes. Read more about our Investment process.

₹2,00,000 via your own Smallcase account.

Typically once a quarter or when required, with a long-term perspective.

An AUM (Assets Under Management) based fee. No hidden charges, no commissions.

No. It’s a rule-based portfolio managed via your Smallcase account. You keep full control of your investments.

The Market Reward Discipline. Not Guesswork

If you’re ready to leave behind high fees, emotion-driven investing, and inconsistent returns, it’s time to upgrade.