Dream Big Series - Mid Cap Prime

Midcap Prime: Value-Driven Stability targets fundamentally strong mid-sized businesses in capital-intensive, cyclical sectors. It blends systematic selection with disciplined risk controls to deliver attractive returns at reasonable valuations—making it a resilient core holding for investors seeking growth and capital preservation through economic cycles.

- Start with just ₹45,000

- Invest in a minutes

- Built on 25+ years of backtested data

- 3 lakhs+ investment rules created

Return Characteristics

Outperformance That’s Consistent, Resilient & Proven

This strategy demonstrates a powerful performance track record, significantly outperforming the Nifty 50 over a 25-year backtest period.

For the 2-year rolling CAGR, it boasts a mean return of 31% and a median return of 31%, markedly surpassing Nifty’s 15% mean and 13% median returns.

While downside risk (MAR <15%) at 0.1057 is slightly higher than Nifty’s 0.0987, the strategy’s superior risk-adjusted returns are evident through a Sortino ratio of 2.9, nearly double the Nifty’s 1.5.

The probability of achieving 15%+ returns over a 2-year period is 68%, far higher than Nifty’s 43%.

Over the 10-year timeframe (FY14–24), this approach has delivered a 17% CAGR versus the Nifty’s 13%, underscoring its consistent and material alpha generation across cycles.

| Metric | Dream Big Series - Mid Cap Prime | Nifty 50 |

|---|---|---|

| Mean (2Yr CAGR) | 31% | 15% |

| Median (2Yr CAGR) | 31% | 13% |

| Downside Risk (MAR < 15%) (2Yr CAGR) | 10.56% | 9.86% |

| Sortino Ratio | 2.9 | 1.5 |

| Probability of 15%+ Returns (3Yr CAGR) | 68% | 43% |

| 10Yr CAGR (FY14-24) | 17% | 13% |

Business Quality Snapshot

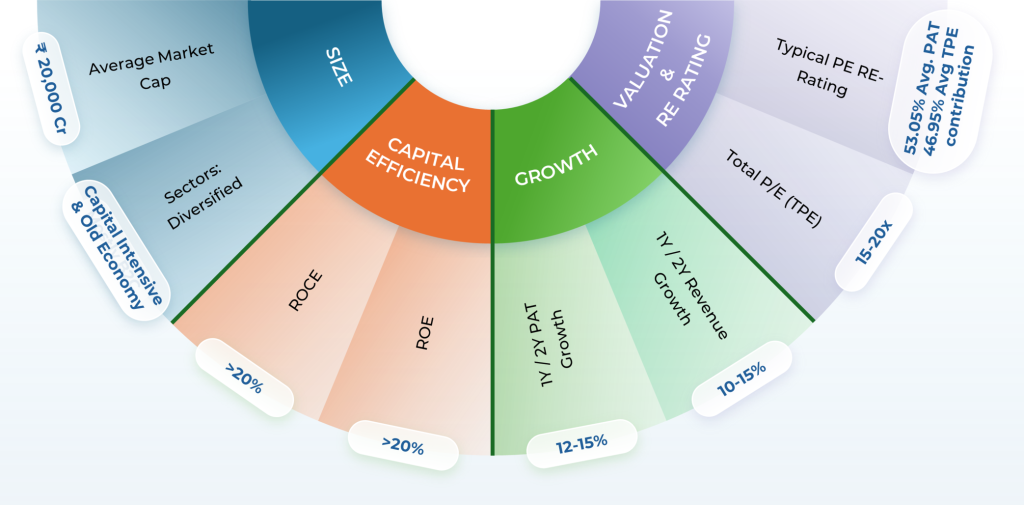

What Defines the Fidelfolio Portfolio

The portfolio primarily comprises mid-sized, capital-intensive companies from the old economy sectors, with an average market capitalization of around ₹20,000 crore.

These businesses are generally diversified but concentrated in industries requiring substantial asset bases and operational scale.

On capital efficiency, ROCE and ROE both exceed 20%, highlighting solid management of invested capital despite heavy asset intensity.

Growth remains healthy, with PAT rising 12–15% and revenue growing 10–15% over 1–2 years, reflecting sustainable expansion.

Companies trade at 15–20x P/E, with contributions balanced between profit growth (53%) and valuation (47%), indicating a mix of earnings quality and market multiples.

Live Performance

Current value of ₹ 100 invested once on Mar 20, 2023, would be

Back-Tested Performance

What Makes FidelFolio Different

Discover how FidelFolio empowers investors with transparent, data-driven investment strategies grounded in 25+ years of historical analysis.

Introducing MAGIC 2.0 – AI for Smarter Investing

Our proprietary AI-ML engine, MAGIC 2.0, tests and combines over 3 lakh investment rules, leveraging decades of financial data to surface the most reliable strategies.

- 20 elite rules powering the Large Cap Dream Funds

- High-return strategies with low downside risk

- Fully transparent fixed-fee structure

Why Trust FidelFolio

At FidelFolio, we prioritize transparency, credibility, and investor-first principles to build confidence and long-term wealth.

We’re not just building portfolios. We’re building investor confidence.

Check out our PortfolioFrequently Asked Questions

At FidelFolio, we follow a quantitative long-term investing approach based on fundamental analysis. Over long-term, company’s business fundamentals determine investment outcomes. Read more about our Investment process.

₹45,000 via your own Smallcase account.

Typically once a quarter or when required, with a long-term perspective.

A flat, fixed advisory fee. No hidden charges, no commissions.

No. It’s a rule-based portfolio managed via your Smallcase account. You keep full control of your investments.

The Market Reward Discipline. Not Guesswork

If you’re ready to leave behind high fees, emotion-driven investing, and inconsistent returns, it’s time to upgrade.

💬 Join Our WhatsApp Channel

Be the first to get investment learning insights, exclusive updates about FidelFolio research, products, and reports, and instant notifications about upcoming webinars. Join our WhatsApp channel and never miss an opportunity to stay informed.

Join WhatsApp Channel