In this article

What is a compounder strategy or buy-&-hold strategy

The oldest and most effective investment strategy, i.e. the Buy-&-Hold investing approach, is probably the simplest to understand. It is built on the most basic principle of investing & finance. But before we get into that, let’s understand what is a buy and hold strategy? Compounder / Buy-&-hold / Quality Investing is buying high-growth quality companies and not selling them soon. This strategy results in low portfolio-turnover (turnover is replacing stocks in a portfolio). This strategy generates return through profit-growth of portfolio companies and DOES NOT involve timing the market. Exhibit 1 below enlists the key components of the Compounder strategy.

Exhibit 1: Key features of Quality Investing / Buy-&-Hold / Compounder Strategy

Underlying principle behind Compounder strategy

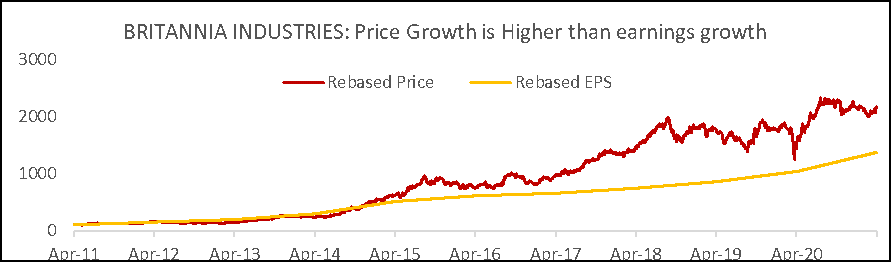

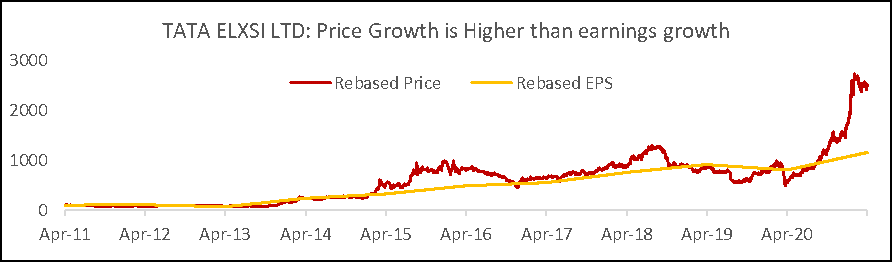

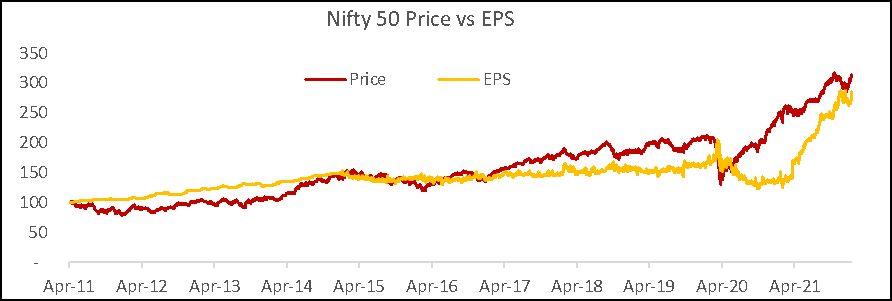

When we follow the simple investment philosophy as mentioned in exhibit 1 above, we make wealth as the investee companies increase their net profits. This is the most basic principle of investing & finance that compounder strategy is based on. This position trading principle states that a company’s market value increases proportionately with increase in company’s profit over the long-term. This principle is approximately exhibited by individual stocks, and more accurately exhibited by a portfolio or collection of stocks. For e.g. exhibits 2 shows that share-prices of individual stocks Britannia and Tata Elxsi largely follow their eps-growth. However, for a basket of stocks like Nifty50, this relationship is even more prominent, i.e. the share-price index even more closely resembles the eps-growth trajectory.

Exhibit 2a: Share Price and EPS growth trajectories have been similar for Britannia

Exhibit 2b: Share Price and EPS growth trajectories have been similar for Tata Elxsi

Exhibit 2c: Share Price and EPS growth trajectories have been more closely similar for basket of stocks like Nifty50

The strategy behind $400 trillion of global wealth

Global Wealth stands at $463 trillion as per Global Wealth Report 2022 by Credit Suisse. One can argue that the majority of this has been created through the buy-&-hold approach. Think of the old & new asset classes – Real Estate, Gold, Private Companies, Listed Companies – all these have grown primarily through holding on to investments for years and decades.

However, when it comes to public markets in the modern era, where buying and selling securities has come to fingertips, indulgence in short-term trading has lured many. Moving from one investment to another seems logical to many, but only at their own peril. Case in point, SEBI’s report on market participants shows that 99% of traders DO NOT even beat fixed income returns in a 3 years’ time frame.

Long-term, buy-&-hold investing philosophy on the other hand, does not depend on exploiting market inefficiencies, it is built on the most fundamental economic principle of economic value-addition and associated reward. Adhering to this principle only can build significant wealth – successful investors can bear witness.

The most successful investors with significant wealth are successful because they don’t lose money in high leakage-cost (price impact, transaction, taxes, etc) due to high portfolio-turnover.

As wealth corpus increases, high portfolio-turnover becomes even more costly, to the point it is impossible to keep growing if portfolio turnover is high. The successful investors keep on increasing wealth by keeping this portfolio-turnover low. Others, slide into mediocrity and don’t scale up.

Why is this simple strategy difficult to implement?

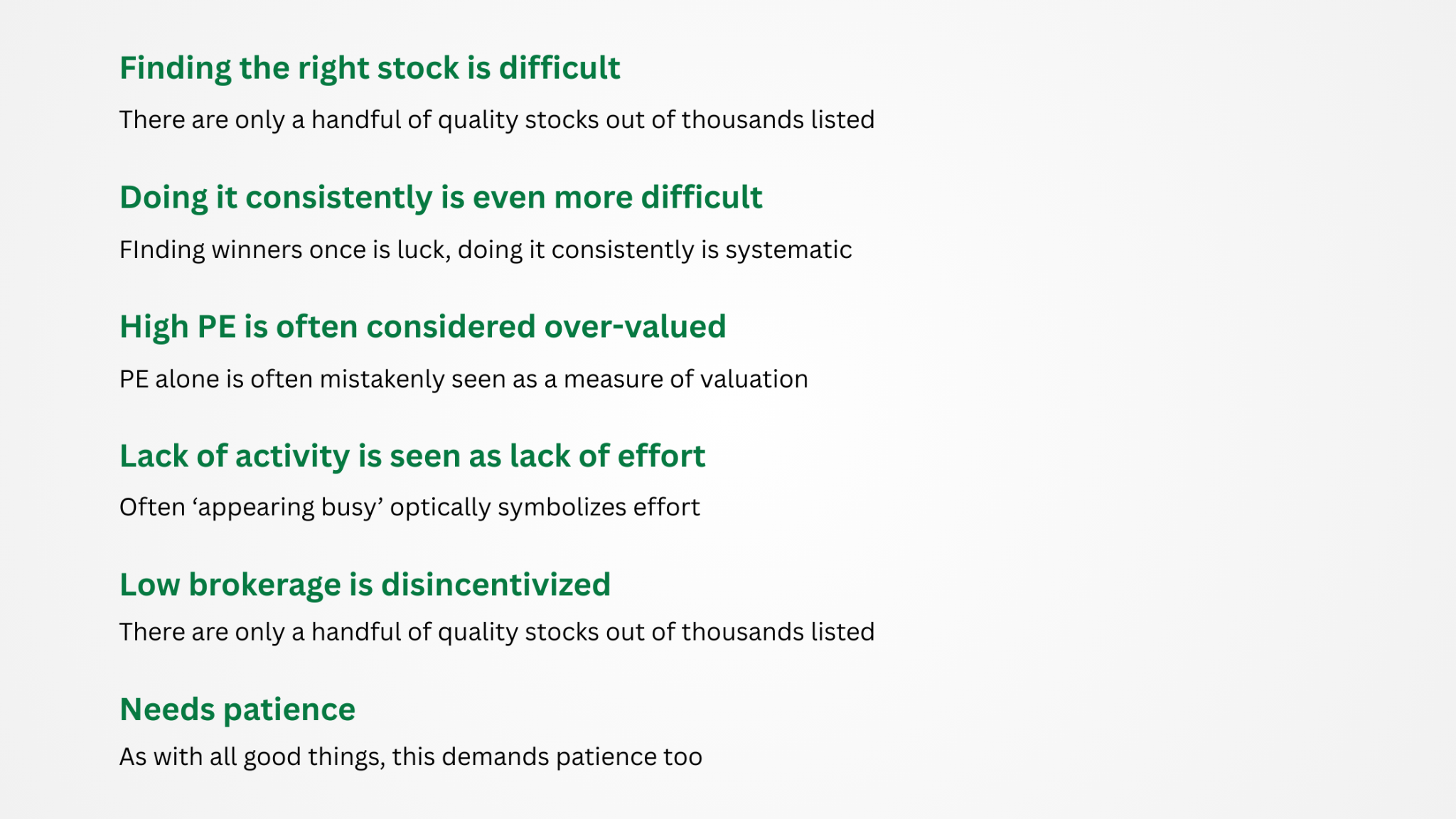

So this should be easy. Find good investments, and hold-on. Right? Well, not really. Remember only successful investors are able to implement this strategy effectively, even though the underlying principle has been an open secret for centuries. So what makes it so difficult to implement these buy and hold investing rules, specifically what are some stock selection challenges that investors face? Exhibit 3 highlights the technical, practical and behavioural reasons for this.

Exhibit 3: Following Buy-&-Hold strategy is not easy

Enter FidelFolio Shivalik & Great Himalayan Compounder

As we mentioned in our previous newsletter (August edition), the difficulties mentioned in exhibit 3 are countered by our AI-ML generated rule-based investment framework. Exhibit 4 shows how each difficulty is tackled. Our ML engines have created investment rules to identify stocks and implement the buy & hold investing strategy. Our system created, backtested and selected most suitable investment rules to create Shivalik & Great Himalayan Compounder – India’s first AI-ML based buy-&-hold investment strategy

Exhibit 4: Fidelfolio’s Investment Framework

Investment rules that form FidelFolio Shivalik & Great Himalayan Compounder

Let’s look at the process of creating Shivalik & Himalayan buy and hold Investing with AI ML strategies using thousands of investment-rules generated & backtested by our ML engines ‘Strategy Creator’ & ‘Strategy Analyser’ respectively. Firstly, we filtered only the rules with the average number of stocks in each portfolio between 10 to 25. From the filtered list of investment-rules, we wanted to use only the rules that lied on the efficient frontier (highest return per unit of risk).

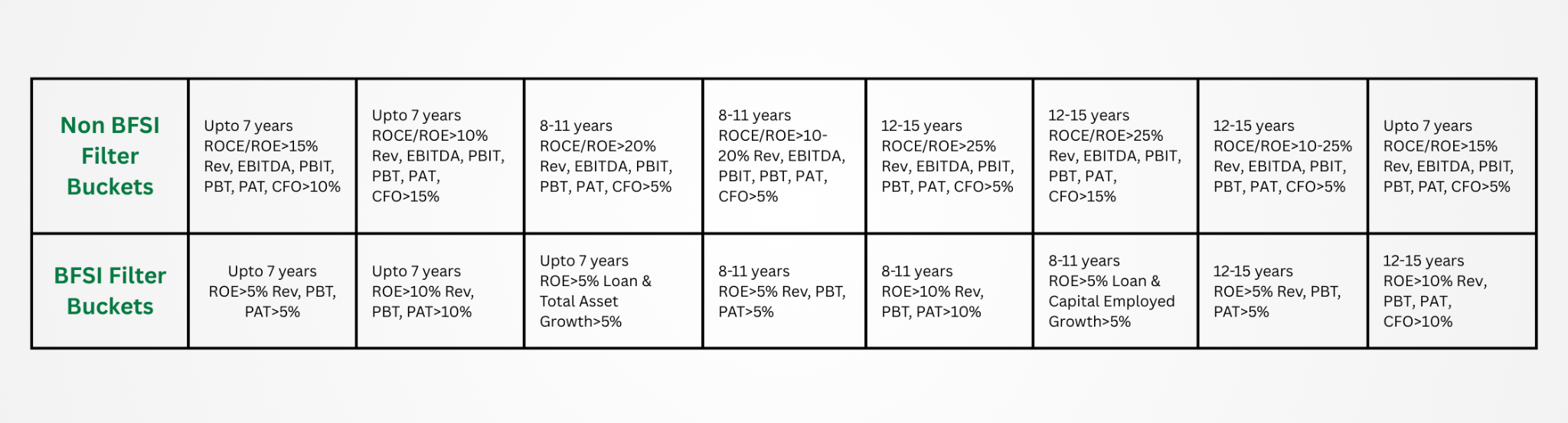

But, the efficient frontier lies across the risk spectrum from low risk to very-high risk. However, there were 142 rules (142 non-BFSI and 92 BFSI) that had the highest sortino ratios and moderate standard deviation among the efficient frontier. We selected these 142 investment-rules to create the powerful Shivalik & Himalayan Compounder strategies. These investment rules are categorised in 8 buckets based on specific ratios, period, filter thresholds etc (see exhibit 5a). A similar process for BFSI investment rules was carried to identify 92 BFSI Filters (see exhibit 5b)

Exhibit 5: BFSI and Non-BFSI Investment-rules that comprise Shivalik & Himalayan Compounder strategies

Understanding Investment Strategies – Example & Backtesting

To make things clear, let’s look at what an investment-rule is. Investment-rule is a set of filters that forms the decision making framework of investing. Such a rule recommends a portfolio of stocks to invest in at any point in time. Let’s look at one of the non-BFSI investment-rules from the chosen 142.

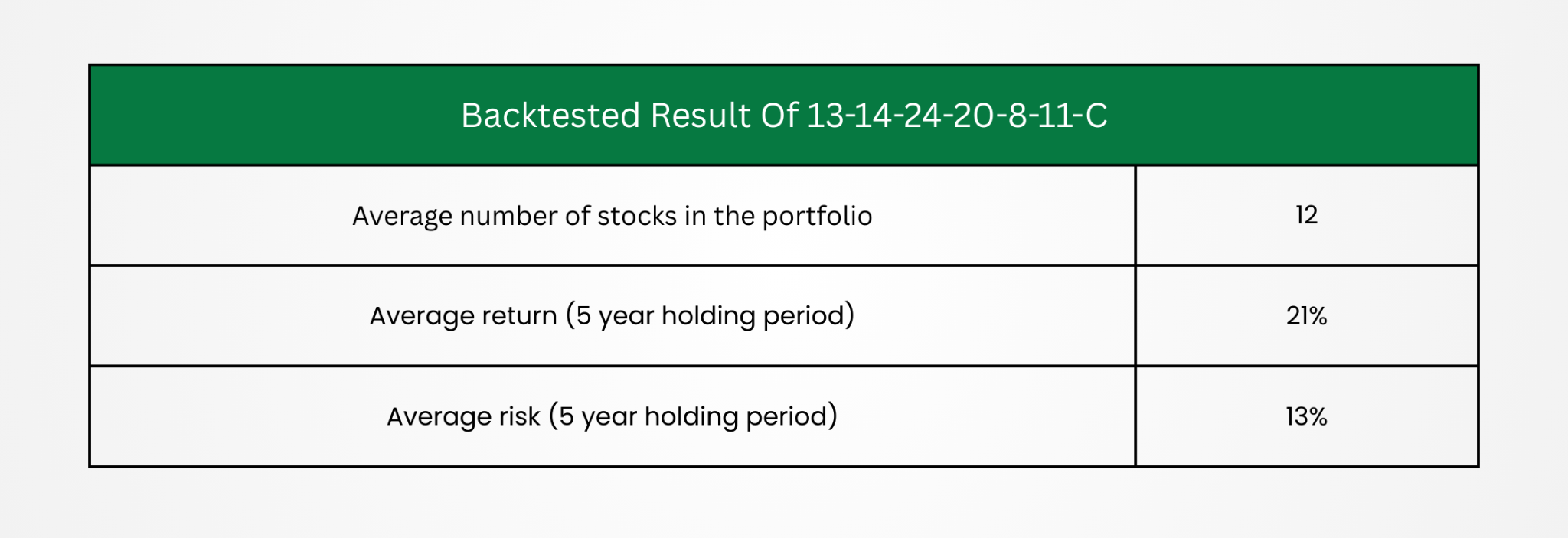

Investment Rule example: 13-14-24-20-8-11-C

Description: The above rules selects all companies that have delivered 20% Return on Equity and 8% Operating Profit Growth in at least 11 of the last 13 years.

This rule in itself is a complete investment plan that generates a portfolio of stocks at any point in time. What would have been the performance of investment using this single rule alone? Exhibit 6 answers that.

Exhibit 6: Backtested Return of a single filter

FidelFolio compounder strategies in detail

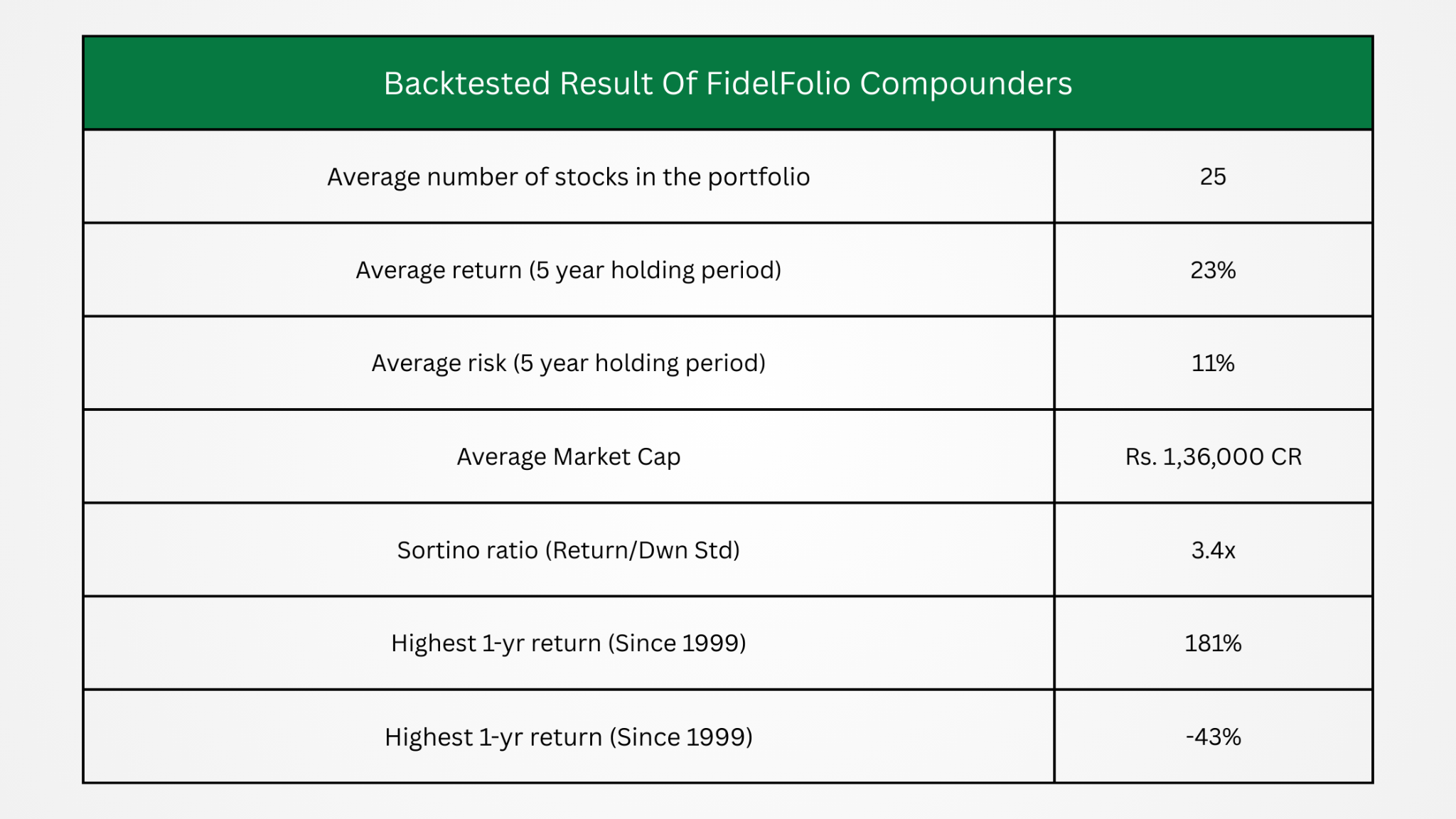

On combining all the selected rules and forming a strategy with an average of 20-25 stocks in the portfolio, the risk-return characteristics improved significantly compared to the individual investment rules, proving how useful the role of AI in buy and hold investing actually is. Exhibit 7a shows the backtested results (for 5-year holding period) of the final Shivalik & Himalayan strategies.

The final strategy built on combining the selected rules fared very nicely even in terms of other metrics like Sortino Ratio, best & worst returns, 1-year return etc. A few details are shown in exhibit 7b.

Exhibit 7: Backtested Return & Other Details of Shivalik & Himalayan Compounder

Qualitative Analysis of Shivalik & Himalayan Compounder

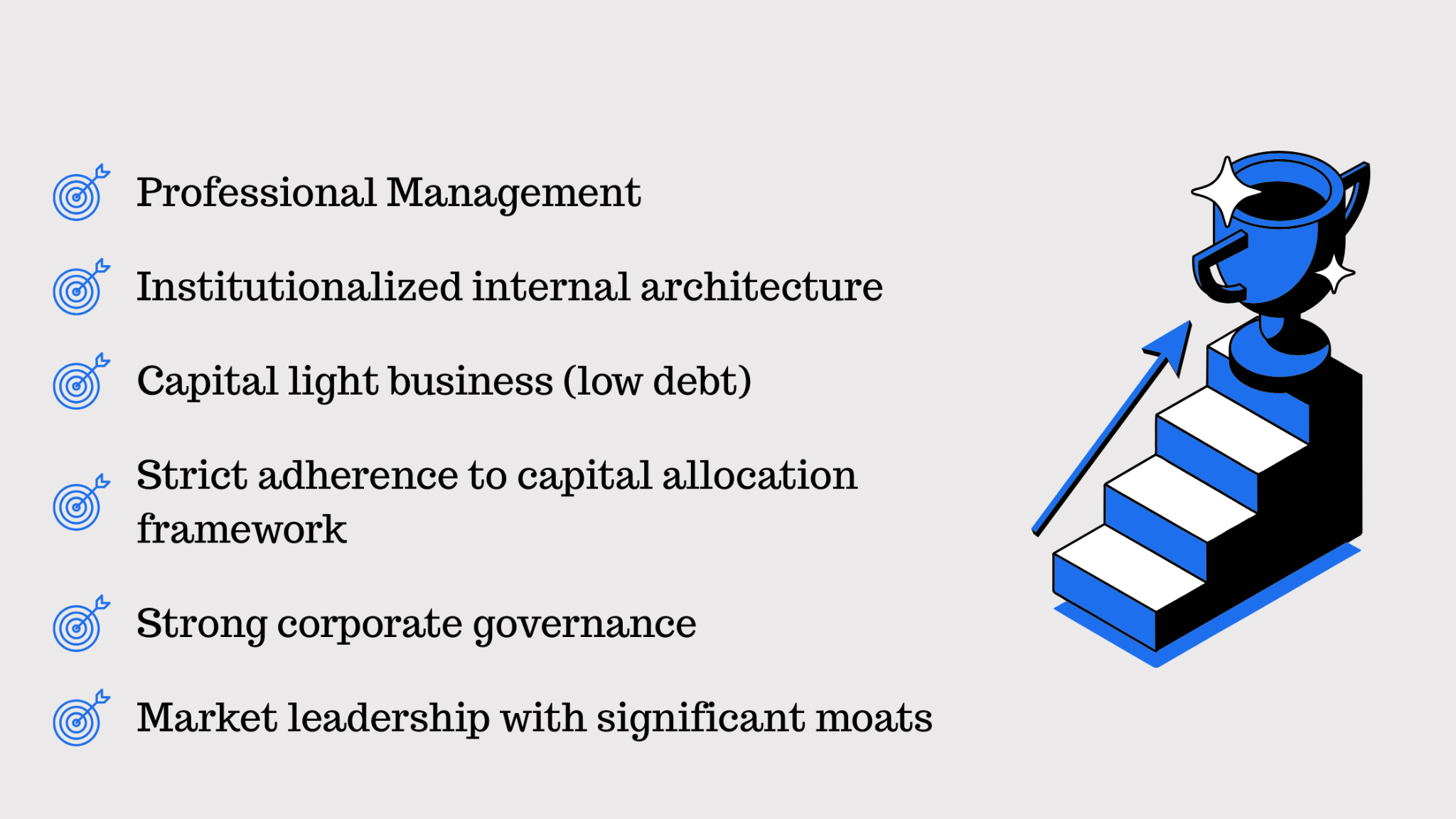

The key qualitative features of the Shivalik and Himalayan Compounder quantitative investing strategies are below:

- Portfolio companies grow their businesses Consistently over years & decades, and with high Capital efficiency (above 25% ROCE)

- Their profits grow much higher than the broader market, with minimum incremental investments

- Consequently, they generate significant, stable, consistent share price alpha over the markets and become tremendous wealth creator

Exhibit 8 shows the traits of of a company that becomes part of the compounder portfolio

Exhibit 8 : Qualitative aspects of the compounder companies

Performance Update of Shivalik & Himalayan

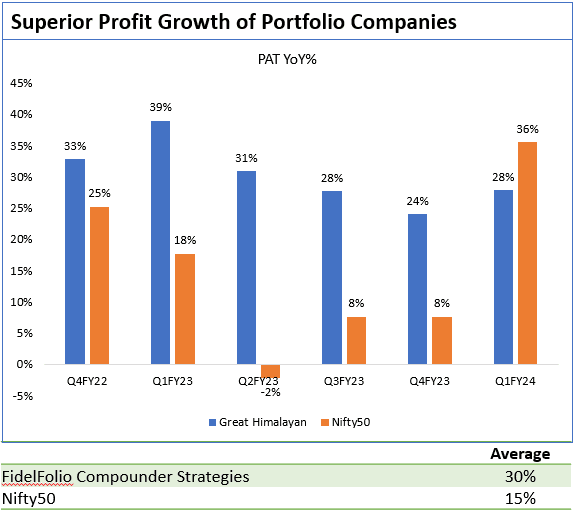

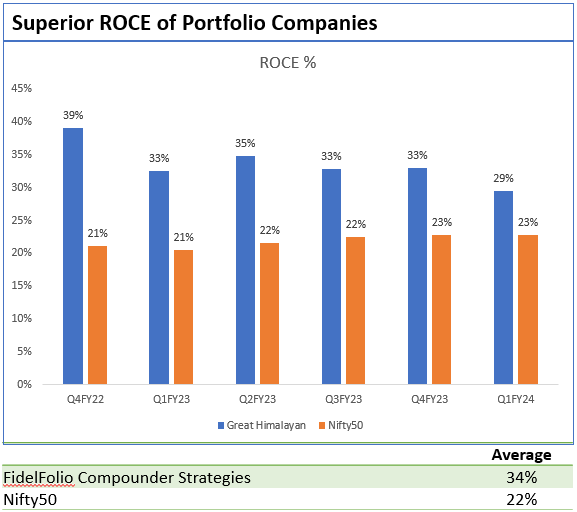

A natural question at this point is – ‘How are the FidelFolio Compounder strategies performing since live launch?’ The easy way to measure portfolio performance is through investment returns. Our strategies have outperformed ALL benchmarks across ALL time-periods. But, just outperforming in terms of investment returns is not sufficient. The underlying reason for outperformance should be ascertained and checked with the strategy’s stated objective. E.g. Our compounder investment ideas are built to identify companies that generate superior profit growth and capital efficiency. Investment returns are supposed to be driven by this only, as explained previously in this newsletter. So, superior price performance should be accompanied with superior fundamental performance of portfolio companies. Only if the latter is achieved will the former be sustainable. Our portfolio companies have heavily outperformed Nifty50 in terms of profit growth and capital efficiency. Average profit growth since inception is 30% vs 15% for Nifty50, and average ROCE is 34% vs 22% for Nifty50. We expect this drastic outperformance to continue to be reflected in price performance also.

Exhibits 9a and 9b show superior profit growth and ROCE of portfolio companies vs Nifty companies since inception of these AI in investing strategies.

Exhibit 9a: Profit Growth of Portfolio Companies vs Nifty50

Exhibit 9b: ROCE% of Portfolio Companies vs Nifty50

Check Out our Live Investment Strategies

Smallcase Name | Risk Profile | Description |

|---|---|---|

Safe Fortress | Low Risk | Long-Term LargeCap |

Shivalik | Avg Risk | Long-Term MultiCap |

Great Himalayan Compounder | Avg Risk | Long-Term MultiCap |

Young Everest Equity | Above Avg Risk | Small-Cap Focus |

Little Orion Equity | Above Avg Risk | Small-Cap Focus |

FAQs.

Q. What is buy-and-hold investing and how does it work?

Buy-and-hold investing is a long-term investment strategy where investors purchase assets, typically stocks, ETFs, or mutual funds – and hold onto them for an extended period, regardless of short-term market fluctuations. The core idea is that markets tend to rise over time despite temporary volatility. Rather than attempting to time the market or make frequent trades, buy-and-hold investors stay invested, allowing compounding returns and business fundamentals to drive long-term growth. This approach relies on discipline, patience, and a belief in the long-term performance of quality assets.

Q. What is AI-ML investing, and how does it apply to buy-&-hold strategies?

AI-ML investing refers to the use of artificial intelligence and machine learning algorithms to analyze data, detect patterns, and make informed investment decisions. When applied to buy-and-hold strategies, AI and ML are used not for rapid trading, but to enhance long-term decision-making. These technologies can identify high-quality stocks with strong fundamentals, forecast long-term trends, optimize portfolio allocation, and assess downside risks over time. Instead of replacing the buy-and-hold approach, AI-ML augments it by providing data-driven insights to help select investments that are more likely to sustain value and deliver returns across market cycles.

Q. What are the future trends of AI and ML in quantitative investing?

In the context of long-term, quantitative investing, AI and ML are expected to evolve in several impactful ways:

- More sophisticated factor modeling – ML will refine factor-based investing, identifying nuanced drivers of long-term performance beyond traditional metrics.

- Alternative data integration – AI will increasingly leverage non-traditional data sources (satellite images, web traffic, ESG signals) to uncover long-term trends and company health indicators.

- Risk scenario simulation – Advanced models will help forecast how portfolios may respond to macroeconomic events, improving stress testing and long-term risk assessment.

- Custom strategy creation – AI will allow for hyper-personalized, rules-based strategies aligned with individual long-term goals, risk appetite, and sustainability preferences.

Ultimately, AI will make long-term quantitative strategies more adaptive, forward-looking, and tailored.

Q. What role does automation play in AI-driven buy-&-hold investing?

Automation is the engine that powers AI-driven long-term investing. Once AI models identify long-term opportunities or risks, automation ensures that portfolio adjustments, like rebalancing, reallocation, or exit decisions are executed systematically and without emotional bias. In a buy-and-hold context, this doesn’t mean frequent trades, but rather timely and consistent actions based on strategy rules. Automation also reduces human error, minimizes transaction costs, and helps enforce discipline, which is essential for sticking to long-term plans through market volatility. It ensures that strategic decisions based on AI insights are carried out efficiently and at scale.

Q. How do AI and machine learning improve long-term investing?

AI and ML improve long-term investing by enhancing decision quality, reducing behavioral biases, and uncovering patterns that humans might overlook. Key benefits include:

- Better security selection – AI models analyze vast datasets to identify companies with sustainable competitive advantages and favorable long-term fundamentals.

- Risk management – ML helps forecast potential drawdowns and adjust exposure to protect long-term capital.

- Portfolio optimization – AI-driven simulations can test how different portfolios might perform across market conditions, improving long-term outcomes.

- Continuous learning – Unlike static models, AI systems evolve with new data, enabling strategies to adapt to changing economic realities.

Together, these capabilities make long-term investing more resilient, evidence-based, and aligned with future expectations rather than past assumptions.

💬 Join Our WhatsApp Channel

Be the first to get investment learning insights, exclusive updates about FidelFolio research, products, and reports, and instant notifications about upcoming webinars. Join our WhatsApp channel and never miss an opportunity to stay informed.

Join WhatsApp Channel