FidelFolio runs on research—it’s our guiding principle.

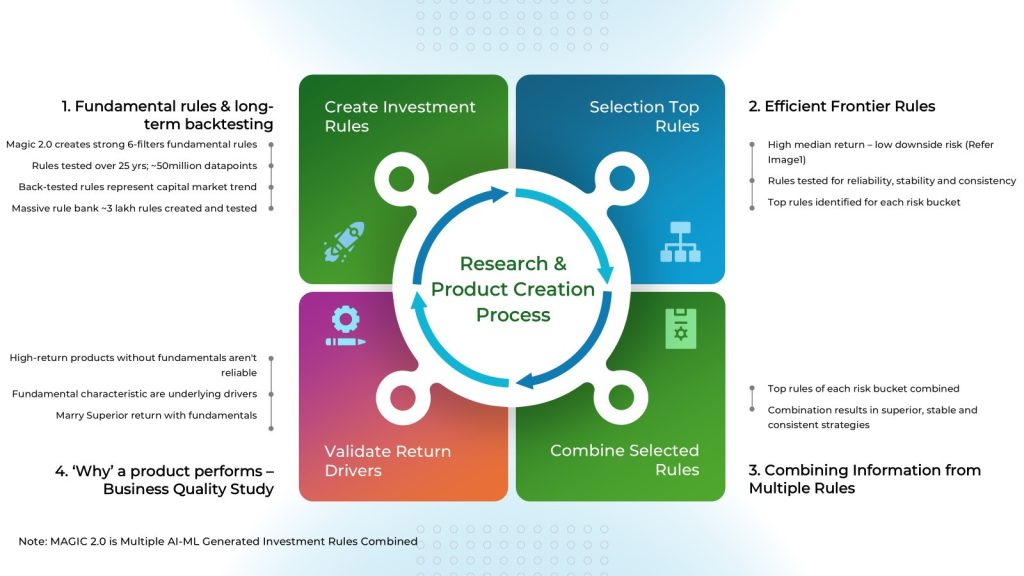

MAGIC 2.0 is the core of this research effort – a multi-stage framework designed to uncover, test, and combine investment rules that demonstrate repeatable patterns of outperformance in Indian equities.

MAGIC 2.0: The Science of Outperformance

MAGIC 2.0 – a multi-stage Multiple AI-ML Generated Investment Rules Combined framework. It is a rules-based investing system designed to uncover repeatable patterns of outperformance in equities. In plain terms, it’s how we use data-backed economic rationale and rigorous backtesting to create reliable investment strategies that anyone – from retail & HNI investors to institutions – can trust.

It’s how we bring science to stock selection, and discipline to portfolio decisions — without losing the essence of long-term investing. The result: a next-gen investing engine built on insights, not instincts.

MAGIC by the Numbers

Developed over years of research, MAGIC 2.0 integrates a wide range of data and technology:

What is an Investment Rule?

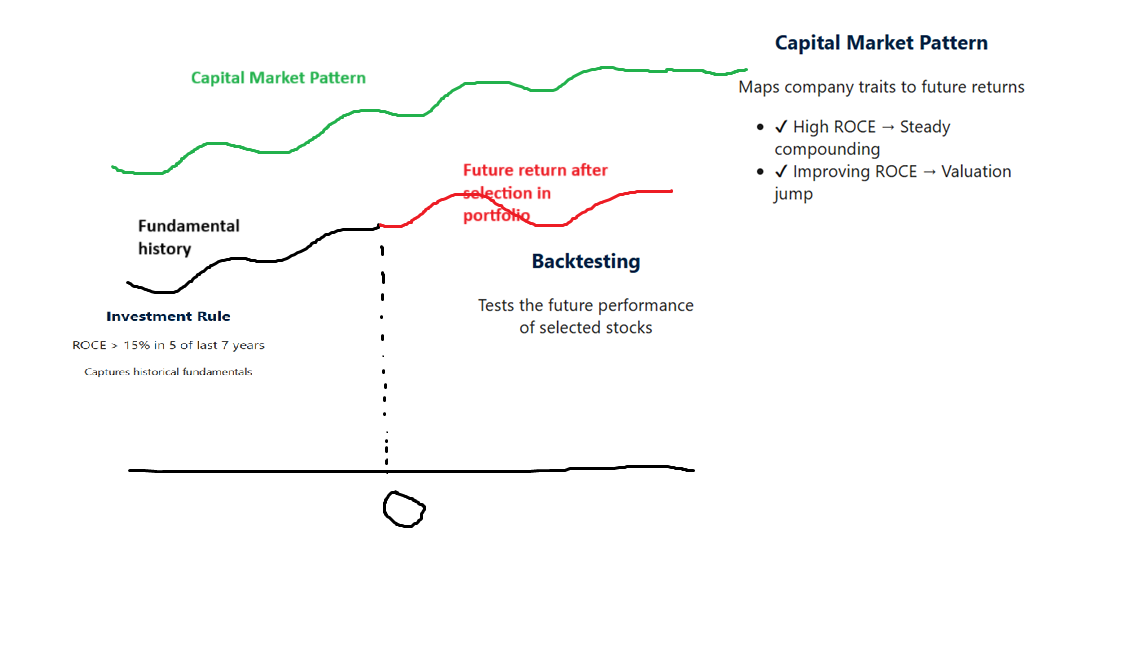

An investment rule is a logical condition applied to a company’s historical fundamental data to decide whether it qualifies for portfolio inclusion. For example, a rule might select companies with Return on Capital Employed (ROCE) greater than 15% for at least 5 out of the last 7 years.

Why Investment Rules Matter – The Evolution

| Problem with Traditional Screeners | How Investment Rules (Fidelfolio) Solve It |

|---|---|

| Just a list of stocks with no action plan | Rules specify what to buy, when to buy/sell, and how much to invest |

| No way to test if screen worked in the past | Backtesting with historical data is integral to Fidelfolio’s process |

| Decisions were subjective and error-prone | Rules remove behavioural bias and human emotion |

| Couldn’t handle complex market scenarios | Rules are stress-tested across various market conditions |

How FidelFolio Rules Work – Step-by-Step

Select stocks with strong quality, growth, and governance.

Stocks qualify for inclusion only if all benchmarks are met.

Clear sell signals like falling ROCE or governance issues.

Allocation determined using equal or factor-weighting.

Rules validated on 10–15 years of bull & bear market data.

Tailored strategies based on investor risk profile.

Key Characteristics

Predictability

Improve consistency and avoid erratic decisions.

Risk Management

Rules are tested against risk factors across markets.

Long-Term Discipline

Encourage holding through cycles with conviction.

Example

- Companies with >20% ROE and >8% Operating Profit Growth in at least 11 of the last 13 years

- Never dropped below 11% ROCE or 5% Revenue Growth in any year

How Rules Are Validated

Historical Backtesting: Evaluate each rule using 10 - 15+ years of market data, including bull and bear phases.

Portfolio Simulation: Simulate how the rules perform across historical timelines by building portfolios and tracking outcomes.

Stress Testing: Assess rule performance during volatile macroeconomic conditions—rate hikes, recessions, policy shifts.

Cross-Validation: Ensure consistency of rule outcomes across sectors, market caps, and different time periods.

Out-of-Sample Testing: Validate performance on unseen data to confirm robustness and avoid overfitting.

Investment Rules Represent Capital Market Patterns

Investment rules are not arbitrary—they embody capital market patterns. When a rule consistently links company fundamentals with future price appreciation, it reflects a structural relationship.

From Single Rules to MAGIC: Why Combine Strategies?

Individual rule-based strategies (like Joel Greenblatt’s “Magic Formula” or the “Coffee Can” approach) have proven the value of systematic investing. A single good rule offers objectivity, transparency, and long-term consistency. However, relying on any one rule has inherent limitations in real-world portfolio management.

Challenges with One-Rule Strategies vs. MAGIC’s Multi-Rule Approach

| Challenge with Single Rule | Solution via MAGIC (Multiple Rules) |

|---|---|

| Limited Stock Picks in Some Periods | MAGIC uses multiple rules so even if one rule finds few opportunities, others contribute — expanding the investable universe without compromising quality. |

| “Good Rule, Bad Stock” Occurrences | Stocks must pass more than one rule — reducing false positives by validating across multiple independent logics. |

| Need for Human Intervention | MAGIC minimizes overrides by using diversified rule sets that cover more edge cases, maintaining scalability and reducing bias. |

| Static and Slow to Adapt | MAGIC evolves over time — new AI-generated rules can be added, allowing the strategy to adapt without losing the proven core. |

🎯 Result: Higher Precision + Diversification + Robustness

- Broader Diversification: A larger pool of stocks that meet stringent criteria — better coverage across market conditions.

- Lower Stock-Specific Risk: No one stock (or rule) dominates — reducing idiosyncratic exposure.

- Quality Consistency: Objectivity maintained from multiple angles — every holding meets layered filters.

- Stable Long-Term Performance: Underperformance of one rule is offset by others — smoother journey across cycles.

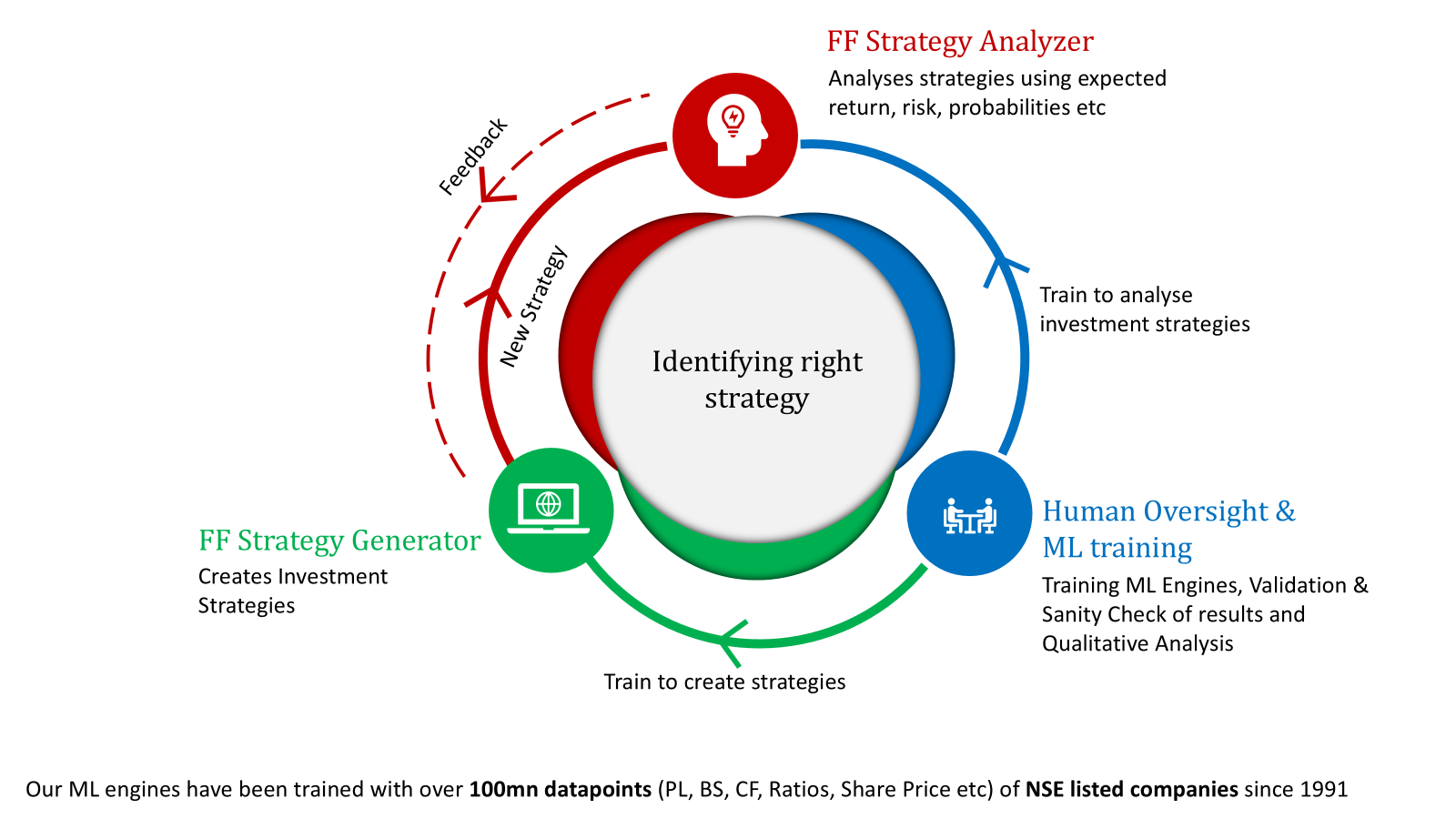

How the MAGIC Process Works – From Research to Portfolio

Creating a robust multi-rule strategy like MAGIC 2.0 involves several stages. Here’s an overview of how we go from raw data to an investable portfolio:

3️⃣ Combining Rules into One Strategy

We create one unified portfolio using selected rules. Each contributes its picks and signals – the outcome is a diversified, balanced, and disciplined strategy.

4️⃣ Oversight & Quality Control

MAGIC isn’t autopilot. We flag stocks for removal via exit rules and conduct human-led governance and quality reviews. This ensures integrity without manual bias.

5️⃣ Fundamental “Sense-Check”

Beyond numbers, we ask “why does this rule work?”. We link rule outcomes to strong business traits like cash flow quality, R&D strength, or governance. This ensures strategies are anchored in fundamental reality, not statistical luck.

The Magic Framework: From Rules to Robust Portfolios

So far, we’ve seen how Fidelfolio builds its approach on a foundation of well-defined investment rules, selects only the best-performing ones through rigorous testing, and then combines them to form robust, diversified strategies. Here’s how the full picture comes together:

Introducing MAGIC 2.0 – What’s New and Why It Matters

MAGIC 2.0 builds on everything we’ve learned — making the strategy sharper, more reliable, and better aligned with investor needs. Here's what we've upgraded and how it benefits you.

🔍 Sharper Filters

Each rule now uses ~6 key fundamentals (like growth, leverage, quality) for deeper, multi-dimensional screening. This improves precision and risk-return alignment.

🧠 Simplified Rule Sets

From hundreds to just 10–20 high-quality rules. This reduces noise, improves interpretability, and enhances reliability through smarter curation.

📈 Higher Reliability

With stricter data validation, rule reliability jumped from ~60% to 95%+. You now get stronger data-backed decisions across time.

🔬 Deeper Fundamentals Mapping

We now link rule behavior directly to business fundamentals like cash flows, R&D, or capital allocation – answering not just what works, but why.

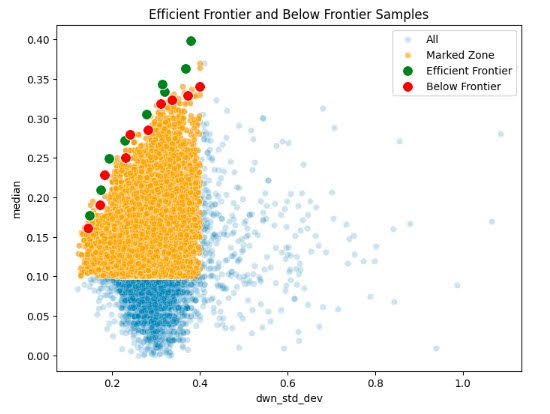

📉 Smarter Risk Metrics

Replacing mean & standard deviation with median & downside deviation gives better investor-aligned risk views and reduces distortion from outliers.

🎯 Efficient Rule Clustering

Rules now cluster near the efficient frontier using base-point logic – delivering better diversification and optimal trade-offs between return and risk.

💡 What This Means for You

- Better Risk–Return Balance: Smarter rule filters help deliver more return for the risk taken – or reduce risk for the same return target.

- More Stable Performance: Rules are chosen for consistency, reducing wild swings and making returns more predictable.

- Greater Dependability: Higher data integrity means you can trust the strategies to behave as expected.

- Clearer Differentiation: Products are now more distinctly positioned, both fundamentally and return-wise.

Designed for Investors who Value process over prediction

Whether you are:

Self-Directed Investor

Looking for structured, institutional-grade strategies

An Advisor

Seeking robust frameworks for client portfolios.

Family Office or HNI

Looking to allocate capital to data-driven public equity models

🌟 Building Trust Through Transparency and Results

MAGIC 2.0 isn’t just an upgrade – it’s our commitment to putting investors first. By grounding our framework in transparency, validation, and objectivity, we’ve redefined what systematic investing should look like.

🔍 Transparent Process

From rule creation to portfolio construction, every step is open and visible – helping you understand how your money is managed.

📈 Proven Results

Backtested across 25+ years and multiple market regimes, MAGIC 2.0 strategies show consistent, high-quality returns – without overfitting.

🤖 No Human Bias

By automating the rule-based logic, we eliminate emotional decisions and ensure every move is driven by data and logic – not instinct or fear.

It’s not magic in the mythical sense – it’s the magic of mathematics, economics, and disciplined thinking. That’s the Fidelfolio promise.

🚀 Explore Our Strategies💬 Join Our WhatsApp Channel

Be the first to get investment learning insights, exclusive updates about FidelFolio research, products, and reports, and instant notifications about upcoming webinars. Join our WhatsApp channel and never miss an opportunity to stay informed.

Join WhatsApp ChannelFeatured In