In this article

Quant Fund Growth in Developed Markets & India: Key Drivers and Strategies

Quantitative (quant) funds leverage algorithm-driven, rules-based models to eliminate human bias and deliver systematic, risk-adjusted returns. In the U.S., quant funds have garnered widespread adoption among various investor groups—common (retail) investors, wealth managers, DIY investors, and institutional investors/asset manufacturers—due to their transparency, consistent performance, and advanced analytics. This report provides an in-depth analysis of quant-specific adoption drivers, supported by extensive research surveys and data reports. It also examines overall growth enablers and challenges in the U.S. developed market and proposes strategies to adapt these success drivers in India.

Introduction

Quant investing represents a significant paradigm shift from traditional discretionary investing. By employing sophisticated mathematical models and algorithms, quant funds reduce emotional bias, improve decision-making consistency, and generate replicable returns. This report focuses exclusively on quant funds by examining their adoption drivers among four investor types in the U.S. and reviewing research data on technological advancements, cost efficiencies, and academic contributions that have propelled this trend. Finally, it outlines strategies for implementing similar quant solutions in the Indian market.

Common (Retail) Investors – Quant Fund Specific Drivers

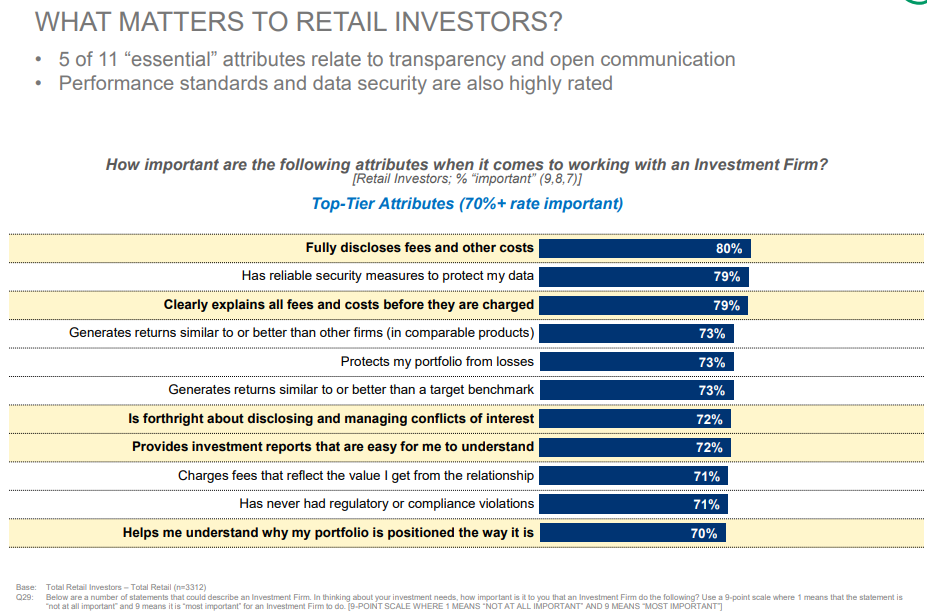

Quant funds offer retail investors a unique, systematic investment approach that stands out from traditional discretionary funds. Key advantages include enhanced transparency, consistent performance, and strong accountability—all critical for building investor confidence and driving customer acquisition.

1. Enhanced Transparency in Quant Funds

Quant funds rely on transparent, rule-based models that clearly define key elements like Quant funds rely on transparent, rule-based models that clearly define key elements like the importance of each factor, when portfolios should be rebalanced, and how risks are managed. This transparency enables retail investors to clearly understand how investment decisions are made, thereby reducing the uncertainty often associated with traditional discretionary funds. By having insight into the precise mechanics of fund management, common investors are better positioned to hold fund managers accountable.

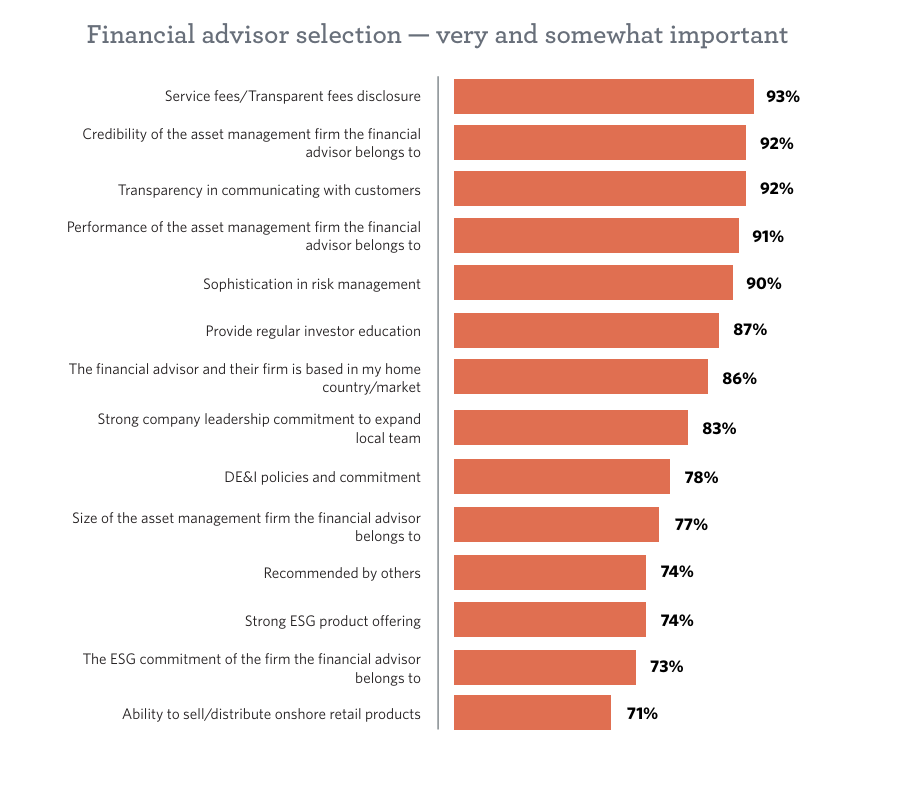

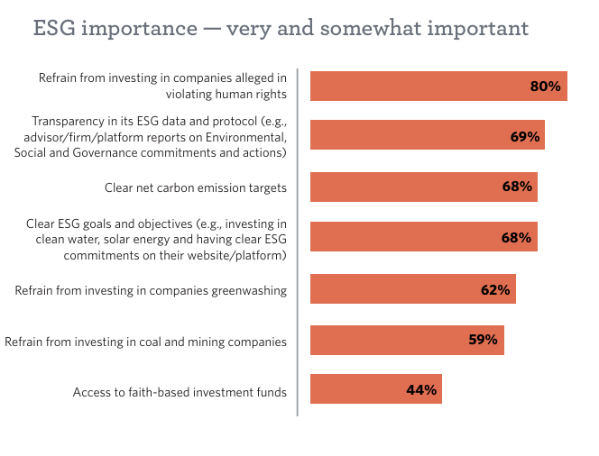

This preference for transparency is strongly reflected in the 2016 global investor survey conducted by the CFA Institute in collaboration with Edelman Berland. The survey, titled “From Trust to Loyalty: What Investors Want”, included 3,312 retail investors from 10 countries, including India, the US, UK, and China, all with investible assets of at least $100,000.

According to the findings, retail investors ranked transparency-related features as among the most important attributes of an investment firm:

- 80% rated “clearly explaining all fees and costs before they are charged” as important

- 79% wanted investment reports that are easy to understand

- 73% Is forthright about disclosing and managing conflicts of interest

These results demonstrate that retail investors place a premium on clear, forthright communication and transparent practices—attributes inherently embedded in quantitative fund strategies.

As such, quant funds are well-positioned to meet these expectations, making them especially appealing to retail investors seeking clarity, control, and accountability in their financial decisions.

Source:

- Hedgeweek – Quant Hedge Funds Increasingly Popular with Investors

- CFA Institute Survey: Investors Want Transparency, Ethics, Performance

2. Source Performance Consistency and Predictability

Quantitative (quant) funds have seen significant growth in the U.S. asset management industry. By 2018, the quantitative hedge fund industry was approaching $1 trillion in assets under management. While specific figures for 2019 are not provided in the available sources, this trend indicates a substantial increase from previous years.Inventure Recruitment

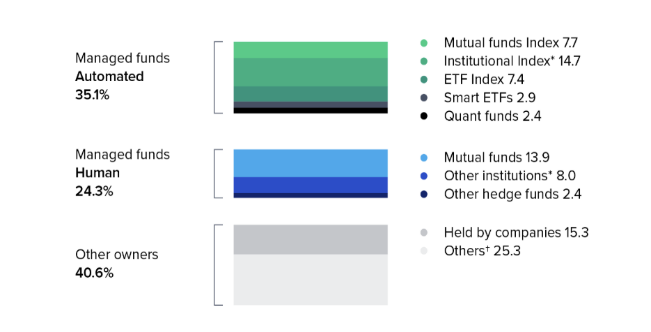

Regarding market ownership, as of 2019, individual investors owned approximately 36% of U.S. corporate equities, with institutional investors holding the remaining 64%. However, detailed data comparing the specific market capitalization held by quant funds versus human-managed funds during that period is limited.SIFMA

In addition, in 2019 quant funds owned 35.1% of the U.S. stock market capitalization, compared to 24.3% held by human-managed funds (toptal.com). While specific, up-to-date data comparing the annualized volatility of quant funds to traditional funds over a 10-year period remains limited, the substantial performance dispersion observed among quant strategies indicates varying risk profiles. This variability underscores the importance of selecting high-quality managers within the quant space to achieve consistent, robust performance. Such consistency enables investors to reliably benchmark performance against a systematic, rule-based model.

3. Digital Accountability and Investor Empowerment

Modern quant investment platforms now offer interactive dashboards that provide real-time performance metrics and detailed model parameters, enabling retail investors to closely monitor portfolio adjustments and benchmark actual performance against the quant model’s forecasts. According to the 2022 CFA Institute Investor Trust Study, 50% of retail investors—and over 80% of institutional investors—reported that the increased use of technology has significantly boosted their trust in their advisers and asset managers, underscoring the value of tech-enabled transparency. The overall trend confirms that these advanced digital tools play a critical role in enhancing investor trust and accountability.

Source:

4. Diversification:

Quant funds often employ systematic, data-driven strategies that are less correlated with traditional discretionary investment approaches. For retail investors, this means gaining exposure to unique return streams that can reduce overall portfolio volatility and improve risk-adjusted returns. As noted in Hedgeweek, “clients are looking for more diversification in their portfolio…within hedge funds, systematic approaches” offer that opportunity—making quant funds an appealing addition even for smaller portfolios aiming for resilience across market cycles.

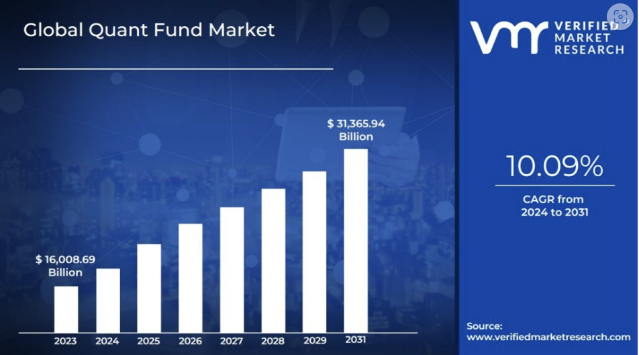

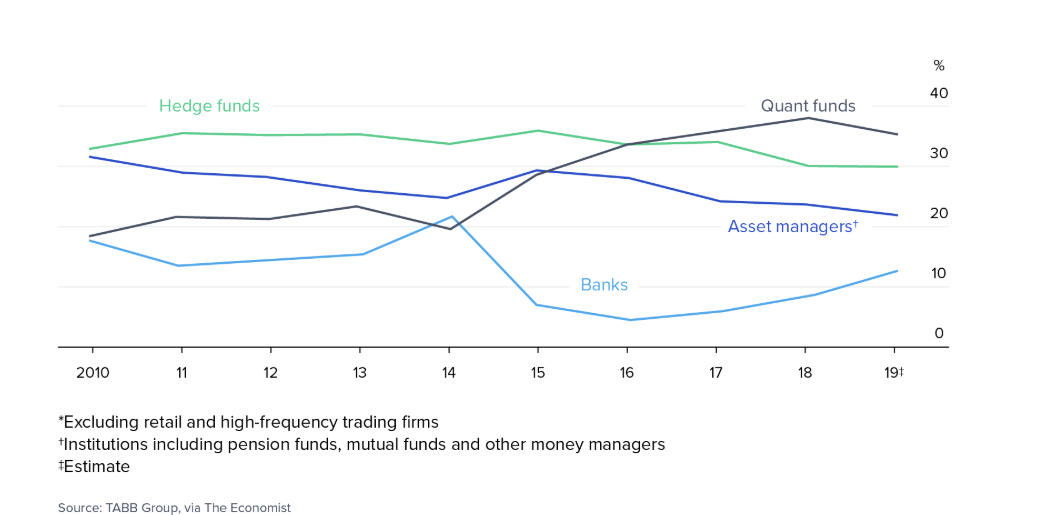

5. Market Scale and Influence

Quantitative (quant) funds have experienced remarkable growth over the past decade, underscoring their increasing prominence in the asset management industry. According to a report by Verified Market Research, the quant fund market was valued at approximately $16 trillion in 2023 and is projected to exceed $31 trillion by 2031, reflecting a CAGR of 10.09% from 2024 to 2031. Similarly, The Brainy Insights via Globenewswire projects that the global quant fund market will grow from $15 billion in 2023 to $38.90 billion by 2033 at a CAGR of 10%. Furthermore, as reported by The Wall Street Journal(kindly visit for a graphical representation of data), quantitative hedge funds were responsible for 27% of U.S. stock trading by investors in 2019, up from 14% in 2013. In addition, quant funds currently manage roughly 16% of actively managed U.S. assets, with assets under management (AUM) increasing from approximately $200 billion in 2010 to over $800 billion in 2020. These data points clearly illustrate the robust performance, growing market influence, and significant scalability of quant funds in today’s investment landscape.

Source: DataIntelo – Global Quant Fund Market Report

Wealth Managers – Quant Fund Specific Drivers

Wealth managers are increasingly choosing to offer quant funds because these products deliver systematic diversification, advanced analytics, and enhanced transparency. These strengths translate into superior risk-adjusted returns, robust client trust, and a competitive edge in today’s market.

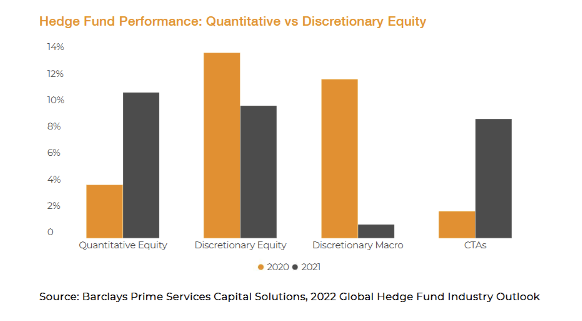

1. Systematic Asset Allocation and Advanced Analytics

Wealth managers deploy multi-factor quant models to diversify portfolios across key risk factors—such as value, momentum, and low volatility. By analyzing hundreds of parameters simultaneously, these models not only aim to improve return consistency but also to reduce portfolio volatility. For example, the Aurum Hedge Fund Data Engine shows that quant funds generated an average return of 12.8% over the 12 months to August 2022, and the quant macro sub-strategy achieved an impressive 20.6% return. These figures underscore the potential of systematic, factor-based approaches to deliver superior performance, even amid high market volatility.

Source:

2. Advanced Analytics & Product Differentiation

The integration of advanced analytics—including machine learning techniques—enables quant models to better predict market trends and manage risk. Although only a portion of institutions currently utilize such technologies (Finadium data indicates roughly 22% regular ML usage), leading quant funds have demonstrated that these methods can generate significantly higher alpha. Case studies from the report highlight that while some sub-strategies (like quant macro) delivered returns above 20%, others such as risk premia underperformed. This performance dispersion illustrates the high-growth potential and innovation of quant funds when properly executed.

Source: Aurum Hedge Fund Data Engine – Quant Deep Dive Report (Refer to pages 11–12 for sub-strategy performance details.)

3. Enhanced Accountability, Transparency, and Client Trust

Transparency in quantitative funds is pivotal for wealth managers as it builds trust and ensures accountability between fund managers and their clients. Traditionally, proprietary algorithms have been closely guarded, but the industry is increasingly embracing openness. Today, sophisticated, user-friendly platforms are being developed that reveal key details of quant models—such as rebalancing triggers, risk controls, and model parameters—allowing wealth managers to offer clients real-time performance monitoring.

This enhanced transparency not only meets the growing demand among investors for a comprehensive understanding of investment strategies and associated risks (as highlighted by Confluence.com) but also reinforces trust by clearly demonstrating how returns are generated, as noted in performance tracking reports from sources like Aurum. According to Robeco.com, this shift toward openness is transforming the industry, with investors valuing clear insights into fund operations and performance. For wealth managers, combining this level of transparency with the consistently strong performance of quant funds significantly boosts investor confidence in the U.S. quant fund industry.

Source :

4. Market Position and Growth Potential

Quantitative (quant) funds have experienced remarkable growth in the U.S. asset management industry over the past two decades. In the early 2000s, quantitative investing accounted for approximately 13% of actively managed U.S. assets in 2003, rising to 16% by 2006 (en.wikipedia.org). By the end of June 2016, the total mutual fund assets employing quantitative models were estimated to exceed $400 billion (en.wikipedia.org), and by 2018, assets managed by quant funds had surpassed the $1 trillion mark (en.wikipedia.org). These data points underscore a significant upward trend in the prominence of quant funds within U.S. financial markets.

Source: Aurum Hedge Fund Data Engine – Quant Deep Dive Report (Refer to pages 17 and 19 for detailed AUM and flow data.)

DIY Investors – Quant Fund Specific Drivers

DIY investors are increasingly attracted to quant-based investment platforms because these systems simplify complex strategies into clear, automated processes. By converting sophisticated algorithms into straightforward, rule-based decisions, quant platforms empower individual investors to build diversified portfolios even with limited capital. Here are the key drivers:

1. Simplified, Rule-Based Investing for Accessibility

Quant platforms break down advanced investment strategies into clear, actionable rules that anyone can follow. This simplicity makes it easier for DIY investors—especially younger generations—to participate in sophisticated investing without needing extensive technical expertise.

Source: Forbes – How Technology And Next-Gen Investors Are Driving the Democratization of Investing

2. Automated Trading and Decision Making

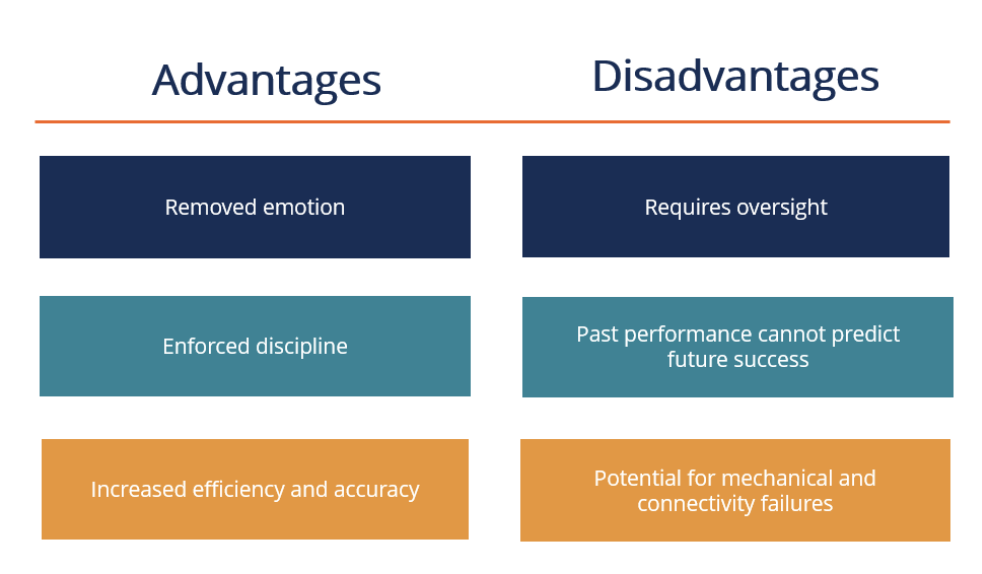

Automated trading systems, integral to quantitative (quant) platforms, execute trades based on predefined algorithms, effectively eliminating emotional biases and ensuring consistent execution. This automation offers several advantages:

- Elimination of Emotional Biases: By removing human emotions from trading decisions, automated systems help prevent irrational actions, maintaining adherence to established strategies. corporatefinanceinstitute.com

- Increased Speed and Efficiency: Automated systems can execute trades in milliseconds, allowing them to capitalize on fleeting market opportunities and respond swiftly to market changes. fx2funding.com

- Enhanced Discipline: The systematic nature of automated trading enforces a disciplined investment process, reducing the likelihood of deviations from the strategy due to emotional reactions. corporatefinanceinstitute.com

Daniel Kahneman’s research in behavioral finance highlights common cognitive biases—such as loss aversion and overconfidence—that can impair investment decisions. Automated trading systems mitigate these biases by relying on data-driven algorithms, thereby enhancing the reliability and systematic nature of quant strategies. boldin.com

The transparency and consistency inherent in automated trading systems foster greater investor confidence and long-term trust in quant fund performance. By providing clear, rule-based strategies and reducing the impact of human error, these systems contribute to a more predictable and trustworthy investment environment.

Source: Investopedia – Algorithmic Trading

3. Transparent Performance Monitoring and Accountability

Modern quant investment platforms offer interactive dashboards that provide real-time performance metrics and detailed insights into underlying algorithms. This level of digital transparency empowers DIY investors to actively monitor their portfolios, benchmark outcomes against model predictions, and hold the system accountable. For instance, Quantbase (getquantbase.com) offers a range of automated investing strategies—from factor-based to algorithmic approaches—through dashboards that clearly display key performance metrics and strategic insights. Similarly, Quiver Quantitative (quiverquant.com) leverages alternative data to offer next-generation stock research tools, giving users enhanced control over their trading decisions. Koyfin (koyfin.com) further complements these offerings by providing comprehensive financial data analysis tools that cover equities, ETFs, and mutual funds, helping investors analyze and monitor their portfolios effectively. Together, these platforms illustrate how enhanced digital transparency in quant investing creates a more predictable, disciplined, and confidence-inspiring investment environment for DIY investors.

Source: The Fool – Robo Advisor

4. Lower Entry Barriers and Cost Efficiency

Quantitative investment platforms have democratized access to advanced strategies by dramatically lowering barriers to entry. Today, many platforms offer features such as low minimum investments, fractional share trading, and reduced fees through automation. For example, Wealthface allows investors to buy fractional shares for as little as $1, making it possible to invest in high-priced stocks and achieve diversification with minimal capital (Wealthface). Similarly, Interactive Brokers supports fractional share trading via its Trader Workstation (TWS) and IBKR GlobalTrader platforms, enabling efficient use of small cash balances (StockBrokers.com). Additionally, platforms like AvaTrade, as noted by QuantifiedStrategies, offer commission-free forex and CFD trading, which further reduces operational costs and fees (QuantifiedStrategies). These advancements mean that DIY investors can now access sophisticated, systematic investment strategies at a much lower cost, enhancing overall cost efficiency and portfolio management..

Sources:

- CNBC – Robo-Advisors Are Gaining Popularity, Can They Replace a Human Advisor?

- Blinklist – Rise of Robo-Advisors: Pros & Cons

- Bloomberg – Quicktake: Robo-Advisers

Institutional Investors / Asset Manufacturers – Quant Strategy Adoption Drivers

Asset manufacturers are increasingly developing and marketing quant funds because these products deliver superior performance, scalability, and strong investor appeal. The following key drivers explain why institutions are shifting toward quant funds:

1. Growing Institutional Adoption and Market Influence

Quantitative (quant) funds have experienced remarkable growth in the U.S. asset management industry over the past decade, reflecting their increasing prominence in global financial markets. According to a 2018 report, the quantitative hedge fund industry was on the brink of surpassing $1 trillion in assets under management (AUM), nearly doubling from the approximately $200 billion reported in 2010 (InventureRecruitment.com). This dramatic increase highlights the scalability and long-term viability of quant strategies, driving significant investor allocation.

In 2024, quant hedge funds continued to demonstrate strong performance, with many delivering double-digit returns. Notably, Business Insider reports that Renaissance Technologies’ Institutional Equities Fund achieved a 22.7% return, while its famed Medallion fund delivered a 30% return (BusinessInsider.com). Moreover, the ongoing integration of advanced technologies—such as artificial intelligence—has further enhanced the efficiency and performance of quant funds, as major financial institutions adopt AI to innovate their services and boost productivity.

These factors collectively underscore why asset manufacturers are increasingly focused on developing and marketing quant funds. Their superior performance, robust growth, and technological edge make them an attractive, high-growth product for institutional investors.

Source: DataIntelo – Global Quant Fund Market Report

2. Superior Performance and Risk-Adjusted Returns

Quantitative (quant) investment strategies have consistently outperformed traditional discretionary approaches, particularly in terms of risk-adjusted returns. Research from Hedgeweek reveals that while discretionary hedge funds may achieve higher absolute returns in rising markets, systematic quant funds deliver lower volatility and better downside protection. For example, during market downturns, quant funds posted returns of -0.03% in 2008 and 1.81% in 2011, compared to -18.65% and -2.83% for their discretionary counterparts. Furthermore, quant strategies can generate up to 30% more alpha under volatile conditions, a performance edge that attracts institutional investors seeking stable, superior returns. This superior risk-adjusted performance not only underscores the resilience of systematic approaches during market stress but also validates the growing shift among asset manufacturers toward deploying quant funds as a high-growth, scalable product in the U.S. market.

Sources:

- Toptal – Quant Fund Performance

- Finadium – Quant Strategies Survey

- Systematic funds deliver higher risk-adjusted returns, research shows

3. Academic and Industry Validation

The growing body of academic research provides a solid foundation for quant investing. For example, one bibliometric analysis titled “Quantitative Portfolio Management: Review and Outlook” (MDPI) identified 473 papers on quantitative portfolio management, reflecting the rapid expansion of research in this field. Similarly, a text mining study on arXiv analyzed quantitative finance papers from 1997 to 2022, underscoring the global—and by extension, U.S.—academic interest in quant strategies. The sheer volume of research indicates that U.S. institutions and scholars are heavily engaged in exploring quantitative investing. This extensive academic validation reinforces the effectiveness of multi-factor models in reducing risk and enhancing returns compared to traditional discretionary approaches, providing asset manufacturers with the rigorous evidence they need to continually refine and innovate their quant products.

4. Operational Efficiency and Lower Costs

High levels of automation in quant funds improve trading accuracy and significantly reduce operational costs. For asset manufacturers, this efficiency translates into lower management fees and reduced transaction costs compared to traditional discretionary funds, enhancing overall profitability and competitiveness.

For example, a study by Fitz Partners—reported by Hedgeweek—found that European cross-border active equity funds charge an average management fee of 0.80%, whereas equity quant funds average only 0.58%, marking a 27% reduction in fees. In the U.S., a survey by Callan (as referenced on Nasdaq) revealed that institutional investors’ average management expenses dropped from 57.3 basis points in 2015 to 54.2 basis points in 2020, reflecting cost reductions driven in part by increased automation. Although precise U.S. transaction cost figures are less available, industry consensus suggests that automated trading systems incur significantly lower costs than discretionary approaches.

These operational efficiencies are a critical driver for asset manufacturers. By lowering expenses and improving execution, quant strategies not only enhance investor returns but also strengthen the competitive positioning of asset managers in the U.S. market.

Source:

- Bloomberg – Quicktake: Robo-Advisers (This Bloomberg Quicktake provides insights into how automation in investment platforms reduces costs and enhances efficiency.)

- Hedgeweek – Fitz Partners Study

- Nasdaq – Callan Survey

5. Enhanced Accountability and Transparency

Quant funds offer transparent, rule-based disclosures of their underlying algorithms—including detailed insights on rebalancing triggers and risk controls—which enable real-time performance monitoring. This high level of transparency is critical for institutional investors and asset manufacturers, as it allows them to hold fund managers accountable. By reducing behavioral biases and ensuring predictable outcomes, such clarity reinforces confidence in the fund’s systematic approach, paving the way for more data-driven, efficient investment strategies.

Source: Hedgeweek – Quant Hedge Funds Increasingly Popular with Investors

6. Accelerating Institutional Demand for Quant Strategies

Institutional investors are increasingly shifting their allocations toward quantitative strategies, driven by their desire for consistency, risk control, and scalable alpha generation. Quant funds’ ability to systematically process large datasets and adapt to evolving market conditions aligns well with institutional goals of precision and efficiency.

This trend is supported by strong industry expectations. According to SigTech’s 2021 annual Hedge Fund Research Report, 80% of hedge fund managers expected institutional investors to increase their allocation to quant strategies over the following year, and 86% projected further allocation growth over the next five years. These figures highlight not only the rising confidence in systematic approaches but also the long-term structural shift toward data-driven investing.

As demand rises, asset manufacturers are responding by expanding their quant offerings—further validating quant strategies as a core component of institutional portfolio construction.

Source: Hedgeweek – Quant Hedge Funds Increasingly Popular with Investors

💬 Join Our WhatsApp Channel

Be the first to get investment learning insights, exclusive updates about FidelFolio research, products, and reports, and instant notifications about upcoming webinars. Join our WhatsApp channel and never miss an opportunity to stay informed.

Join WhatsApp Channel